Monthly savings calculator

Starting capital

Yearly return

Monthly savings

Number of years

Total savings

How does the calculation work?

The calculation works by taking the most basic factors of investing and calculating the compound growth of your investment. If you don´t know what compound growth is, I wrote about it in an article called The power of compound growth.

Compound growth is extremely powerful, Einstein once said “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

Practically it will make your investments return much more than you think, making the time shorter for you to reach your investment goal.

We will run through a few examples to show how.

Starting capital: Do you need it?

There is absolutely no need to have a starting capital, but it should be noted that it has a very high impact on the outcome in the end since it will contribute to growth for such a long time.

To explain the impact let´s look at what happens to $10,000 in starting capital. If you invest $10,000 at the start it will be worth the double, or $21,049 to be exact in 11 years at a 7% yearly return.

To see this example in the calculator, use the sliders to set the following values:

Starting capital: $10,000

Yearly return: 7%

Monthly savings: $0

Number of years: 11 years

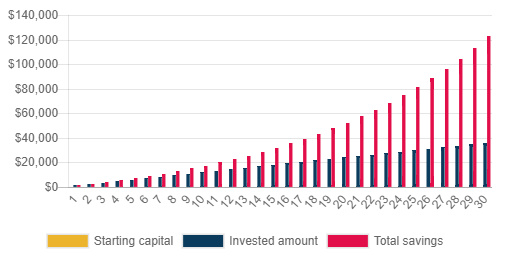

To take a real-life example, if you are 20 years old and save $100 per month until you are 50 years old, you would have spent a total of $36 000 which after 30 years would be worth $122,709 at a 7% yearly return.

That would be equal to more than a tripling your invested capital, not too bad!

As you can see from the chart the total savings (red bar) will grow much more than the invested amount (blue bar) over time.

To see this example in the calculator, use the sliders to set the following values:

Starting capital: $0

Yearly return: 7%

Monthly savings: $100

Number of years: 30 years

Conclusion

Having a starting capital is a great way to boost your investment but it´s not necessary to achieve great results.

Tips: Move capital from a low interest paying bank account into an investment account

Avoid: Don´t move all your money into your investment account, the stock market will fluctuate over time so keep in mind that the money you invested will not always be available to you on a short notice.

Yearly return: What is a reasonable rate of return?

No one knows how the stock market is going to perform in the future, to find a reasonable estimate we can only speculate and look at the historical returns of different asset classes.

One thing everyone usually agrees on is that the stock market as a whole goes up over a longer period of time. With that in mind, it´s preferred to invest in the stock market for long-term investment, rather than having cash in a drawer.

In this calculation, we have not taken inflation into account, which will dilute the value of any uninvested cash over time.

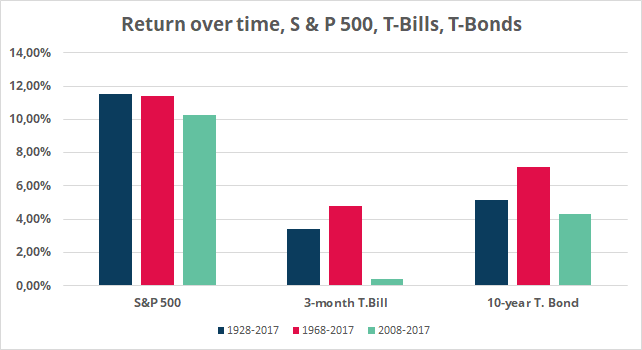

Here is a summary of average yearly returns for S&P 500 between 1929-2017

- Stocks (S&P 500): 12% per year

- 3-month treasury bills: 3.44%

- 10-year treasury bonds: 5.15%

1929 was a long time ago but the point here is just to conclude that the stock market generally goes up over time.

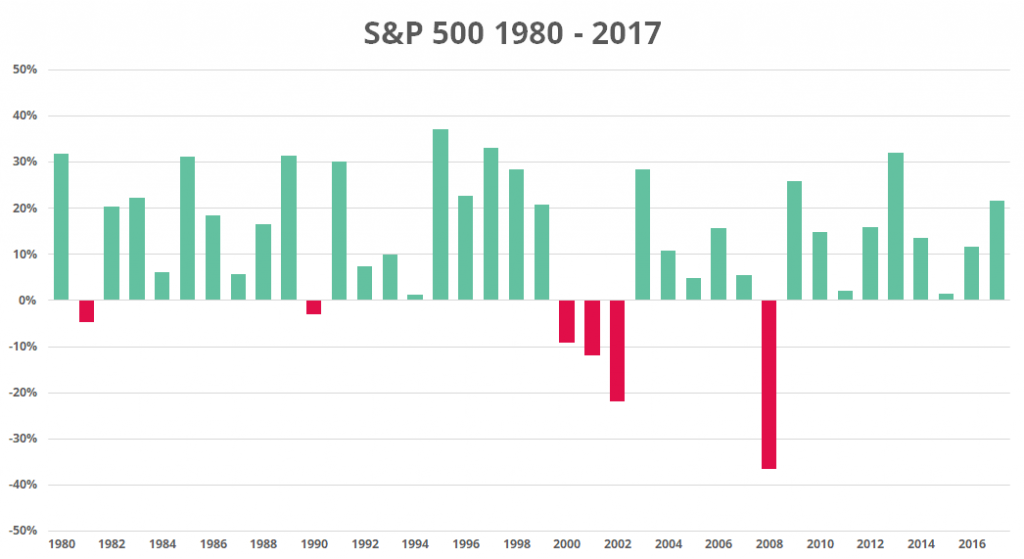

To take a more near-term example, lets look at how the S&P 500 has performed since 1980.

The average for the period 1980-2017 is as follows

- Stocks (S&P 500): 13% per year

- 3-month treasury bills: 4% per year

- 10-year treasury bonds: 8% per year

Bonds are considered a less risky investment than stocks but doesn´t produce the same returns as stocks.

On the other hand, there are niches which could produce even higher returns, Small Cap Stocks is one example or take tech stocks over the last 10 year, though at a higher risk.

This chart shows how Stocks (S&P 500), T-Bills and T-Bonds have performed over different time-periods. Note that stocks generally perform higher than bonds for all time period.

| Period | Stocks (S&P 500) | 3-month treasury bills | 10-year treasury bonds |

|---|---|---|---|

| 1928-2017 | 11.5% | 3.4% | 5.2% |

| 1928-2017 | 11.4% | 4.8% | 7.2% |

| 1928-2017 | 10.3% | 0.4% | 4.3% |

A popular choice among many bloggers is to invest in index funds. Investing in index funds will give you more diversification than investing in individual stocks. It´s a great choice if you have a long-term investment strategy and you believe that the stock market as a whole will go up over time.

In the examples, I have looked at the stock market as a whole over a long time, though the stock market will go down and have a “correction” from time-to-time.

Timing these events is extremely difficult, even for an experienced investor. If you explore blogger articles around their investment strategies they will often quote “Time in the market is more important than timing the market”.

If you don´t think you are better and can´t time the market better than the market itself, better stick to the strategy of being in the market as much of the time as possible since the stock market will go up over time as a whole.

Monthly savings: What should you invest in and how much?

What´s a good investment strategy? Well, that´s a million dollar question in itself and there is not a definite answer to it. Though there are some guiding rules and principles one can apply.

The first thing to understand is that all investments have a risk and generally speaking, expected higher returns also comes at a greater risk.

They key factor here is to aim for long-term steady growth of your portfolio, that effectively excludes all sorts of short-term high-risk strategies such as day trading, forex, binary options and who knows what companies are marketing, trying to lure you into a trap which will most likely make you lose your money.

I have previously written about how to create diversification for your portfolio and why a buy and hold strategy may be right for you.

To find inspiration from other successful investors you can explore members portfolios on KINFO, here you will find both private investors and bloggers who share their portfolio allocation with the community.

Whether you decide to invest in stocks, aiming for growth, dividend returns or take a safer route investing in index funds, you will find plenty of members on kinfo who have well-diversified portfolios and achieve great returns.

To learn more about the background to their investment decisions, bloggers often share their thoughts in articles about their portfolios. In each bloggers profile, you can find a link to their blog to read more or check out some of the featured bloggers at the end of this article.

How much you can afford to invest is very individual, a good start is to create a budget and set up a goal to invest an amount you are comfortable with every month.

Number of Years: How long time should you keep your investments?

There are really two questions you need to ask yourself

- How much: How much money do you need?

- When: When are you going to need that money?

Many would think of retirement as a goal where the age may differ depending on how keen you are to retire early and how much capital you think you need to retire comfortably.

If you have no clue, there is nothing wrong with setting a very long time-frame. Famous investor Warren Buffet once said: “Our favorite holding period is forever”. It´s a great rule!

Is that it or are there other things worth noting?

Yes, there is, of course, many more things which will affect the returns on any investment. One thing we haven´t taken into account is inflation which dilutes the value of money over time. A long-term investment strategy in the stock market is still good against the effect of inflation

Another factor is tax implications but that´s a topic for another article.

Where to find inspiration

A great source of information to learn more is to read personal finance blogs. Bloggers will often share their personal stories and describe their investment strategy and experience in detail. From here you can learn more about things not covered in this article such as deciding your investment goal & strategy and how tax implications affect your investment.

Many bloggers also share their portfolio on KINFO. By exploring blogger portfolios you can see exactly which stocks, funds or ETFs they have invested in.

Below is a list of blogs I recommend reading.

Physician on Fire, or PoF as he calls himself is an anesthesiologist, family man, and supposed outdoors enthusiast who says he spends way too much time indoors.

He runs a blog since 2016 dedicated to the discussion of issues pertaining to personal finance, early retirement, medicine, and miscellany. He posts new material a couple times a week as long as I have something to say, and readers to read.

PoF attained financial independence (the F.I) at age 39, meaning he could afford to retire comfortably after a 9-year career. He continues to work for various reasons, and still enjoys his job but have plans to retire early.

PoF is a great inspiration for anyone trying to build wealth through long term investing.

Read his blog at: https://www.physicianonfire.com

We can cal him mr DDD for Dads dollars and debts. DDD is a physician, family father who lives in California.

He writes about the journey to find happiness and financial freedom. DDD has been through some great challenges when his house burned down in the Tubbs fire in 2017. Despite that he continued to blog about topics such as budgeting, tax implications on various accounts and setting up living trusts.

DDD is a long term investor as most bloggers, he invests primarily in index funds.

Read his blog at: https://www.dadsdollarsdebts.com/

He is a husband. Father (of three). A sinner. A philosopher. An author. An inventor. And I happen to be an anesthesiologist.

He runs a blog and writes mainly towards medical professionals about how to achieve wealth without forgetting the purpose and obtaining wellness.

Read his blog at: https://thephysicianphilosopher.com