What Is an Option Spread?

A spread option is a type of option contract that derives its value from the difference, or spread, between the prices of two or more assets. Spread options differ from various option spread strategies constructed with multiple contracts on different strike prices or differing expirations. Other than the unique type of underlying asset—the spread—these options act similarly to any other type of vanilla option.

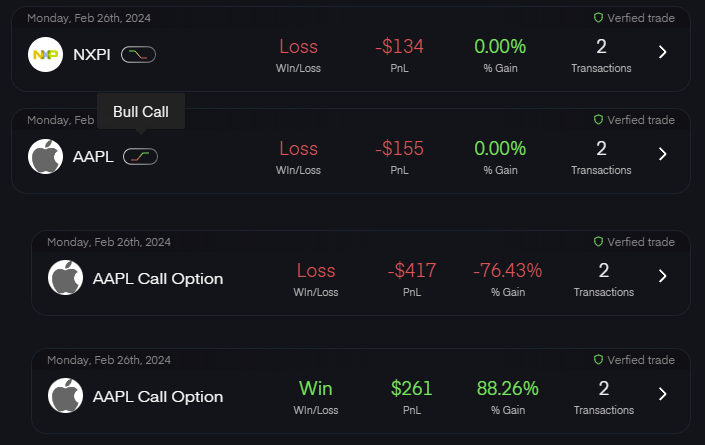

Option spreads and Win %

When trading spreads, there will many times be one winning trade and one loosing trade and the combined PnL will determine if the spread trade was profitable or not.

This means that the win rate % will not reflect the win rate of spreads but on the individual trades and result in 50% if trading 2-legged spreads.

Spread detection and grouping on kinfo

With PRO+, kinfo supports automatic detection and grouping of veritcal spreads.

PnL will be recorded for the spread and wether it was a win or loss as well.

Supported spread types

Kinfo supports the most commonly used spreead types

Condors

- Iron Condor

- Reverse Iron Condor

- Long Call Condor

- Long Put Condor

- Short Call Condor

- Short Put Condor

Strangles

- Long Strangle

- Long Guts

- Short Strangle

- Short Guts

2-legged

- Bull Call

- Bull Put

- Bear Call

- Bear Put

Butterflies

- Iron Butterfly

- Reverse Iron Butterfly

- Long Call Butterfly

- Long Put Butterfly

- Short Call Butterfly

- Short Put Butterfly

Straddles

- Long Straddle

- Short Straddle

- Strip

- Strap

Box Spreads

- Long Box

- Short Box

Enable spread detection

Spread detection can be enabled under Settings -> Trade Settings

To use spread detection, a PRO+ subscription is required

Limitations

Vertical & horizontal spreads

Spread detection currently supports vertical spreads and not horizontal.

% Gain

Spreads will not have a % gain

Multiple spreads intraday on same ticker

If you have multiple spreads on the same trading day on the same ticker it won´t separate them into individual spreads.