A trading journal is tool for day traders where you enter trading data in order to analyze your performance and behavior to then understand what steps you need to take to improve your trading results.

A trading journal is a must-have tools for any serious trader because it helps you stay structured and follow the routines of your day trading strategy. It also shows when you make mistakes and makes it easier to understand how to overcome those mistakes.

While most traders try to understand why they are not successful, professional traders rely on tools like trading journals to quickly find, analyze and eliminate mistakes in their behavior.

What is a Trading Journal?

In it´s simplest for, a trading journal is a list of records listed in a chronological order where each record represents a trade taken by the trader.

Each trade record consists of information about that trade such as time-stamps for entries and exits, entry and exit prices, position size, direction as well as other information and data points that the trader may find useful to record.

The records should also contain information about the outcome, if the trade was a win or loss, gain or loss in dollar amount as well as gain or loss in percent. This information is important to show for analysis and to quantify the impact of a successful trade or a mistake.

In addition to actual data and outcome, a trading journal can also contain personal notes, these could be related to strategies, patterns, setups or just notes about mood and mental state.

Why use a Trading Journal?

You might ask yourself, do I really need to go through the work of tracking all my trades in order to be successful?

Well, it´s not a straightforward yes or no for all traders if you don´t have top-notch metrics, it´s an easy to use and valuable to to improve your results.

Trading journals software and tools

Pen & Paper

What came before all the technical tools we have today? Pen & Paper of course. How old-school it may sound, it´s still better than nothing. The benefit if writing things down is that it has strong ties to learning, more so than writing things on a computer.

The drawback is that it´s tedious and you can´t do any automatic calculations.

Note-taking apps

A quite popular choice is to use generic tools like Asana, Wunderlist, Evernote and other types of note-taking apps to record trades.

Still better than nothing and faster than Pen & Paper but lacks the ability to do any type of calculations based on the data.

Excel

A far better choice than note-taking is to use Excel, it´s a fantastic tool since it supports the tabular format necessary for structured record-keeping and it has tons of built-in capabilities to do calculations and visualizations.

A benefit you get with Excel is the flexibility to create anything you like from calculations or visualizations, you’re practically only limited by your imagination.

The downside is that you still have to enter all your trades manually and you need to have some Excel skills to do any meaningful analysis.

If you want to try it out, I have written a tutorial on How to create a trading journal in Excel

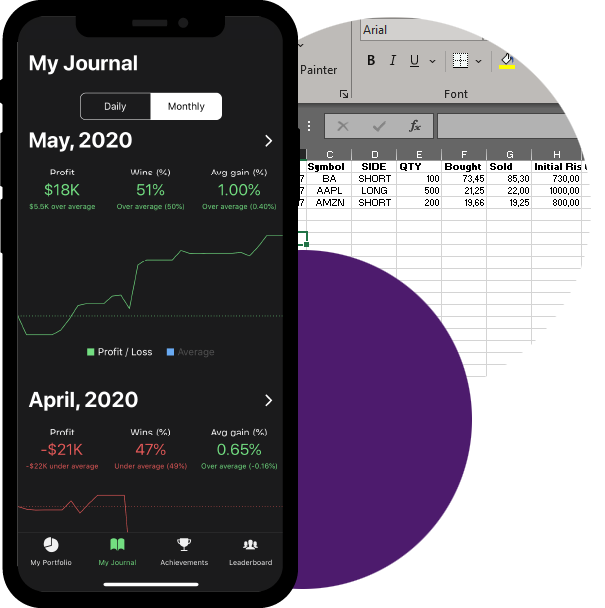

Trading journal apps like kinfo

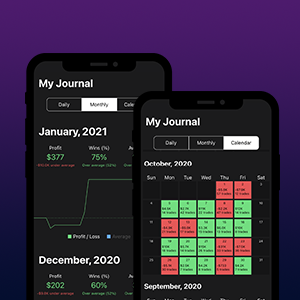

The kinfo trading journal provides some benefits which are hard to achieve in any of the above methods.

A benefit that comes out of the box is that it integrates directly with your broker. It will match transactions to construct trades and provide a large set of performance metrics, statistics and visualizations for easy follow-up without the technical hurdle using Excel.

Since kinfo is available as both an app and web version, you have your journal easily accessible at all times.

How to use a Trading Journal in 3 Steps

The journal is of no use if not used in the right way, luckily this process is very easy to grasp and also very similar to how journaling and self-improvement is conducted in other areas outside trading.

Step 1 Add Data

The first step is to record entries, the minimum information to record is information and data points about the trade + the outcome of the trade

Step 2 Analyze your Data

The simplest way to analyze a journal is to just re-read it and take note of mistakes you made.

Traders who have a large number of trades may have a hard time identifying patterns by just re-reading the journal. In those cases, traders have to rely on more advanced analysis. This can be achieved by tagging and grouping trades and further analyze the outcome of those tagged groups.

Step 3 Identify mistakes and make adjustments

When analyzing you data you will likely come across patterns that stand out and.

Examples:

You deviated from your strategy and traded something you shouldn´t which led to a loss.

You have repeatedly made the same mistake over and over again without realizing it.

Now to the hard part, to stop doing the things that contribute to losses…

How to do this is different for every person, but one thing is for sure. The journal isn´t lying and it´s in your self-interest to take the learnings that the journal is providing and make sure to change your behavior.

What are the Benefits of a Stock Trading Journal?

1 A Trading Journal Will Help You Stay Disciplined

Discipline is hard not only when trading but hard to achieve in any area where you are force to re-evaluate what you are doing and accepting that you have made mistakes that need to be corrected. Without any type of structure, the “forget and move on” mentality often takes over and you will return to find yourself doing the same mistake over again.

Having a trading journal at hand helps with the discipline of continuously find and identify mistakes in your trading and to stop making those mistakes in order to be a more consistent trader.

2 A Trading Journal Will Help You Master Your Emotions

In trading, emotions will most of the times work against you. A developed trading strategy in itself doesn´t understand emotions, it´s just data point leading to actions, where data points can be anything from price action, patterns to correlation with other types of market data.

If you ask any successful trader about their mistakes, they will tell you a story about when emotions took over and they deviated from their trading strategy.

The trading journal will help you stay true to your strategy and when you start to deviate from your trading strategy based on emotions, a trading journal is a great tool to have and take notes of those mistakes.

3 A Trading Journal Will Improve Your Risk Management

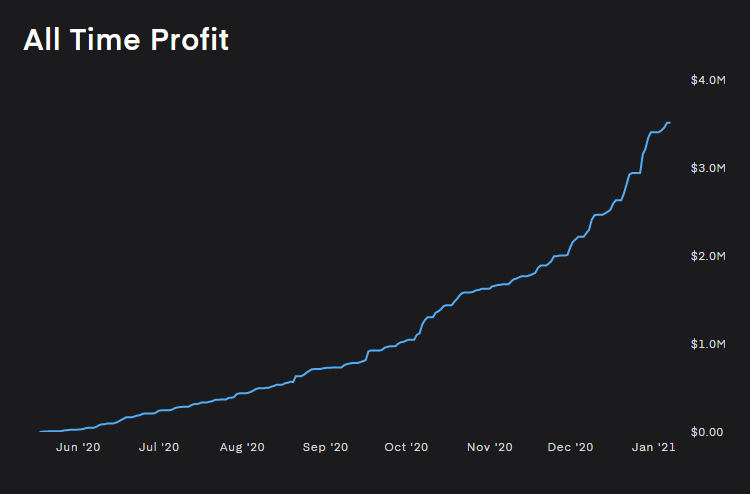

The biggest difference between successful traders and beginners is not how much they make on their wins, it´s how much they loose on their lost trades.

Successful traders make mistakes and have losing trades, but with proper risk management, they make sure that their losses are limited.

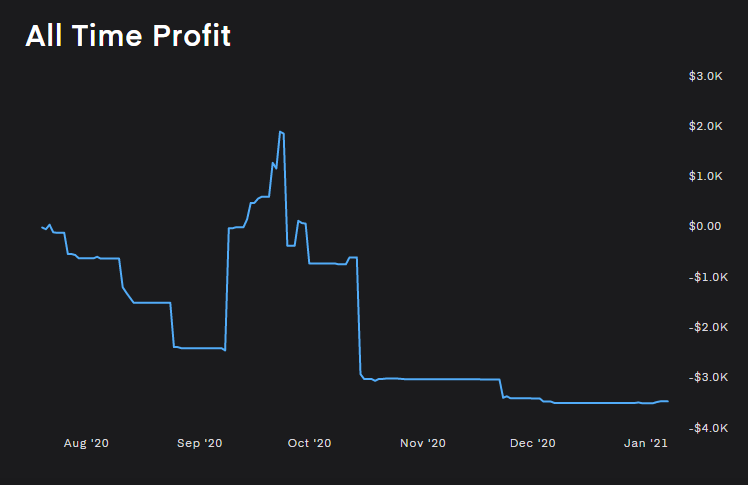

A typical beginner portfolio will look like this, a bit of a roller coaster ride with some gains and losses over time but what stands out is that the drawdown are large in relation to the account size.

With proper stop-loss and pre-set risk/reward calculation this should never happen.

But again, mistakes happen, and keeping track of mistakes to avoid repeating them is a success factor that differentiates consistent traders from those who are struggling.

4 A Trading Journal Will Help You Ascertain Each Setup’s Viability

Setups are an important part of a day traders’ strategy, and traders often have multiple setups that they utilize depending on the situation.

What can be hard to see, is which of these setups resulted in consistent trades and which didn´t.

If you use tagging or another type of structured commenting in your journal, you can easily follow up on these metrics and take action.

Keep using the setups that have proven to be consistent and stop using the ones where you loose money.

5 A Trading Journal Can Help You Work on Your Weaknesses

Even if you stop with the failing setups and continue with the good ones, you are not done. Development of a successful trading strategy is something that takes time and in order to develop you need to go outside your comfort zone and try new methods.

The big difference is this, with a trading journal at hand you can do that in a controlled and structured way with measurable results.

As you are working on goals to improve your trading, a good practice is to pick a few focus areas to focus your improvement on. Using the trading journal you can go back in time and compare the improvement period with a period in the past to evaluate if you have improved.

With proper stop-loss and pre-set risk/reward calculation this should never happen.

But again, mistakes happen, and keeping track of mistakes to avoid repeating them is a success factor that differentiates consistent traders from those who har struggling.

Hint, most trades aren´t consistently profitable, but they aren´t consistently non-profitable either. They make profits over time but loose it all in one or a few trades.

6 A Trading Journal Helps You pick side and instrument type and time-frame

Successful traders don´t go haywire and grasp for every opportunity that occurs, they have a strict ruleset based on what works and wait patiently for the right opportunity to arise.

The stock market has a lot to offer and it´s practically impossible to be good at everything. For this reason, you should find what where you are profitable and where you make losses in terms of side, instrument type and time-frame.

- Are you most profitable when going LONG or SHORT?

- Are you most profitable trading stocks or options or another instrument type?

- Are you most profitable scalping or swing trading?

- Are you most profitable trading low-float penny stocks or large cap companies?

These are some of the questions you should ask yourself. A trading journal helps you get the needed answers and ways to niche your trading strategy to become more experience a new level of results.

7 A Trading Journal Helps You Set up Goals For Your Trading

When traders get started, they often set up a dollar-based goal related to how much money to earn from trading.

A goal that broad is marginally useful since it´s hard to convert into actionable changes to the trading strategy or even to start identifying where to improve.

How much money one can earn is very much related to account size and what risk/reward scenario the trader is willing to trade.

Being consistently profitable boils down to two main metrics. Your winning trades percent & your average gain per trade.

If you have over 50% winning trades and your average gain per trades is above $0 you are on a good pathe of being consistently profitable

These two metrics is what makes it possible to earn X amount of money in a certain time-frame. A trading journal makes it possible and even easy to track these metrics over time.

If you win 50% of your trades and you win slightly more on your winning trades than you loose on your loosing trades. Then you are good!

Now, there are traders who rely on a strategy where they don´t win 50%, only say 40%, but they make up for it by having larger gains on their wins than they have losses on their lost trades.

8 A Trading Journal Holds You Accountable

Emotions is something every trader fight against and as humans we tend to forget about our mistakes and just brush it under the carpet and move on.

The trading journal, however, doesn´t forget about mistakes and will hold you accountable for them. It´s valuable to able to look back and think about what went wrong during your largest losses and think about what must change in order avoid repeating the same mistake.

9 A Trading Journal Brings Consistency

We just have to admit that if we had a perfect memory and weren´t affected by mood, we would probably perform better as traders, but after all, we are human.

To stick to your trading strategy and not deviate from it, is something that takes practice and often a few bumps in the road to master.

But once you start utilizing your trading journal to stay true to your strategy, you will become more consistent. Mistakes will still happen and has to be analysed and corrected, though they wont have such a large impact as before and you are less likely to repeat them.

It´s one of the hardest things but it´s possible to achieve and with it comes great results.

10 A Trading Journal Increases your Edge to Improve Your Trading Performance

Becoming consistent is all about getting the numbers right. You either need to win more trades than you loose or you need to make more on the winners than you loose on the losers.

Journaling is not unique to trading, any elite athlete keep a journal with information relevant to their training, results, goals and mistakes. It´s probably safe to say that any athlete on elite level would not be where they are without a structured way of journaling their training schedule and activities.

A trading journal is a simple to use tool, easy enough for anyone to use, yet one of the most powerful tools to achieve great results.

In terms of work and effort, a cheap tool to increase your edge to improve your trading results.

Learn more

The kinfo Social Trading Journal

Learn more about how you can utilize kinfo as an automated trading journal

Creating a trading journal in Excel

Learn how to create a trading journal in Excel with a dynamic dashboard