Why Investors Should Remember the Dunning-Kruger Effect

A surging stock market is thrilling. This excitement comes not only from rising share prices but from the vindication of knowing our investments were a wise decision. However, can we really congratulate ourselves? The Dunning-Kruger effect says no.

Stepping Off the Sidelines and into the Market

Passive investing works. Most of us have read the studies and reviewed the numbers. Owning a piece of the total market simply makes sense. Here’s another idea that makes sense, living your life in your own style. KINFO users know how.

Positioning For a Bear Market

Investor sentiment is positive, the market is rising and the fun is going strong, right? Maybe not. Recent news has touted a fall in the “Fear Gauge” to a 23-year low. The CBOE VIX Index shows that investors, on the whole, are more optimistic than ever. What happens when the market corrects? KINFO has answers.

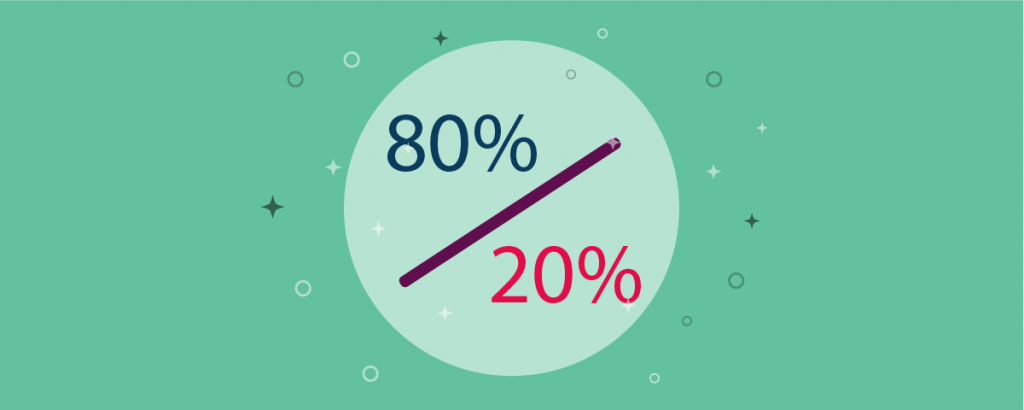

Making the “Pareto Principle” Work For You

What does the history of Italian land ownership have to do with your portfolio? According to economist Vilfredo Pareto, the connection is clear. The earning power of your investments is often concentrated in just a few holdings. KINFO can help you find them faster.

KINFO and the Innovation of “Swarm Intelligence.”

Despite all of our technological advances, humans can still learn a lot from animals. Scientists have discovered that animals working as a group almost always outperform individual creatures when solving problems. These groups operate as one through nonverbal cues. KINFO is putting this idea to work with investors.

Broaden Your Social Circle For Fewer Emotional Decisions

As children, we’re told, “do what your heart tells you.” Unfortunately, it takes a long time (and some losses) to learn that our heart doesn’t understand the stock market. Too many investment decisions are emotional. However, collaboration on KINFO is changing the game.

How Collaborative Investing Prevents Behavioral Finance Pitfalls

Humans aren´t born investors and there are many aspects of our natural behavior which points us in the wrong direction under certain conditions. However, we are smart enough to understand our limitations and create structures around it to prevent pitfalls.

Using The Position Increase/Decrease Filter to Build a Momentum Strategy

Newton’s first law of motion tells us that, in essence, a body in motion will remain in motion and a body at rest will remain at rest. This concept forms the underpinnings of a momentum investment strategy. This approach seeks to build wealth by purchasing securities with established uptrends. KINFO’s Position Increase/Decrease filter can help.

Using The ‘Largest Position Filter’ in KINFO To Diversify Risk

Modern Portfolio Theory (MPT) is one of the biggest breakthroughs in the history of finance. The idea is simple: risk should be measured based on the relationship stocks in a portfolio have to one another. Let’s look at how KINFO users can put this idea into practice.

Why Hedge Funds Are Easier To Emulate Than Join

For many investors, a hedge fund is a ship on the horizon that will never come to port. These mystifying funds seem full of promise and unimaginable wealth. In truth, much of the appeal of such an investment is based on its private nature rather than sound fundamentals.