Background

From time to time I see rumors surface on X that kinfo can be gamed somehow. They often take into extremes as it´s easy to game the system and for that reason, kinfo is fake and useless.

The reality is that no one thinks more about how to game the system than me, for the sole reason of identifying potential integrity issues and correcting them.

There is currently no proof of any method to game the system, but I would like to take the opportunity to describe some of the theories, how they would work in practice and the facts and math behind them, since this is something people often get wrong.

Using multiple accounts

This comes up in a few different forms such as “What if I have multiple accounts and only show the profitable”, or “What if I trade on one account and offset the same trade on the other account, then show the profitable”

The first thing to understand is that kinfo is only as good as the length of a traders track-record, when reviewing traders on kinfo, it´s up to you to review the length of the track record and decide what value you put in a trader with a week of data vs a trader with 3 years.

With that said, any trader could be profitable in a single day, a bit more difficult in a week and increasingly more difficult to achieve consistent profits over multiple years.

Would it be easier with 2 accounts? Not necessarily, let say you are profitable on one account and not on the other. As much as you don´t know if your next trade is going to be a win or a loss, you don´t know which account will get the winning trade if you offset it on 2 accounts.

Offsetting strategy and math

Lets take a more scientific approach to the problem and evaluate what it takes to create a winning offsetting strategy.

- To model the problem we need to think in number of trades rather than time, but for clarity, we can assume we take one trade per day.

- The goal is to create a strategy with 100% wins on one accounts

- We are not concerned about actual profits since we are only interested in gaming kinfo, get attention and sell an expensive course.

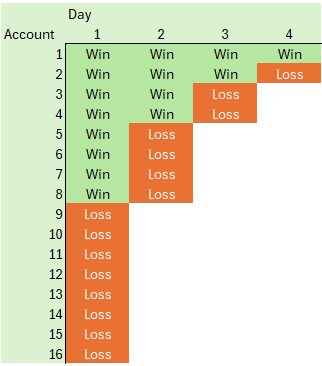

- Before going into the math, lets just put it into Excel to visually see what we want to achieve. Lets start with 4 days which looks like this.

As you can see we need 16 accounts.

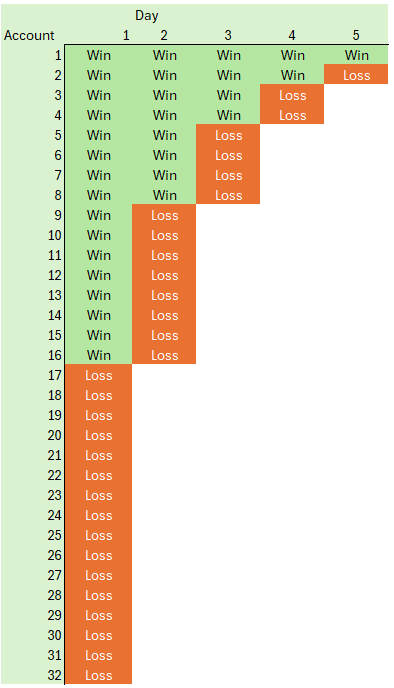

Now lets add another day to make it 5 days.

Now we need 32 accounts, and you can probably see where this is going.

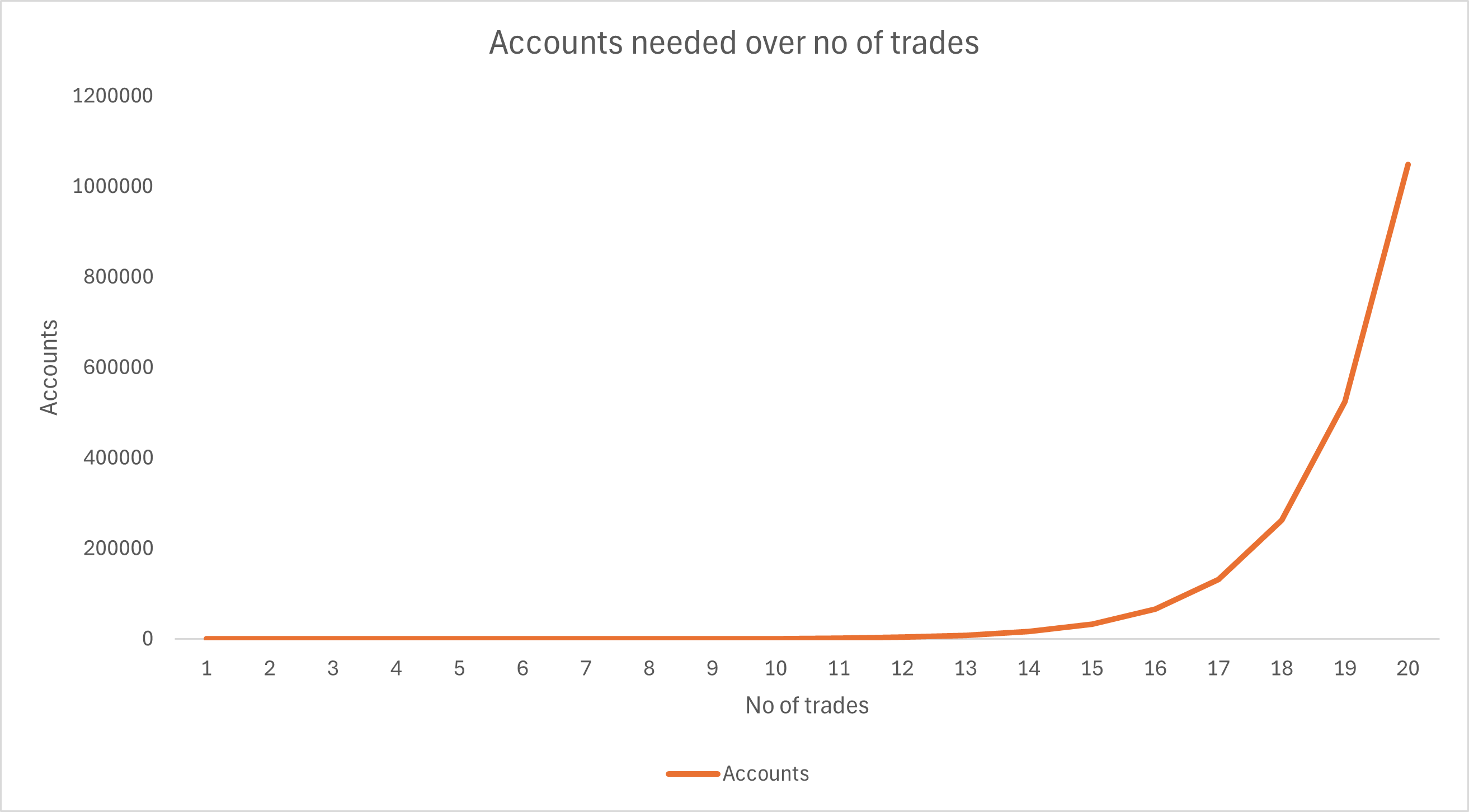

In order to get one guaranteed win account we need 2^X accounts, where X is the number of consecutive days we want to achieve with our strategy.

So in order to get just 20 consecutive days you need 2^100 (1 048 576) accounts.

And in terms of capital, assuming you trade $100, you need around $100 million starting cash to end up with a 20-day total $2k streak.

Never close losing trades

As described in how kinfo calculates trading metrics, a trade will only be recorded once it´s closed out. This opens up to a strategy where you would never close a losing trade, just leave it open with one share.

Now, even if this actually works, you can only do this once per ticker. Let me explain.

Let’s assume you traded NVDA at a loss and just partially close the trade leaving it open with 1 share. The trade will never show up on kinfo and accumulate to your total PnL.

The week after there is a new opportunity where you think you have a play on NVDA, you trade NVDA and you make a profit. The problem is that you can´t fully close the trade and make the profit shown on kinfo, without fully closing it and showing your previous loss as well.

While this method is somewhat possible it´s extremely high maintenance. You would need to keep track and maintain records of your unrealized losses and make sure you don´t trade these tickers again.

Over time your universe of tickers you are allowed to trade will decrease until there are no tickers left.

The platform already has fail-safes to show partially realized profit but someone has yet to prove to put this into practice long-term.

Even if you did this, would you still be a good trader with an increasingly diminishing universe of tickers and increasingly higher maintenance of non-tradable tickers? I don´t know but I doubt anyone can put this into practice long-term.

Other methods

The two above are the methods that seem to be most difficult for people to understand. However, there are occasionally rumors that you can manipulate trades, use sim or paper trading accounts and get verified etc.

This is of course not possible, I encourage everyone who thinks it possible to try out the platform and explore how the integration to brokers work.

If anything new arises where I see people having difficulty understanding the facts and math, I will add an explanation to this post.